Vin’s Holdings Ltd (SGX:VINS) convened its inaugural Annual General Meeting (AGM) on 8 May 2025, offering shareholders a detailed look at the Company’s post-listing trajectory. The session offered shareholders key insights into the Company’s financial performance for financial year ended 31 December 2024 (FY2024) and its strategic priorities for the near term, while reiterating the plans outlined in their recent IPO.

The Board declared its first post-IPO dividend of 1.16 Singapore cents per share, comprising a final dividend of 0.77 cent and a special dividend of 0.39 cent. This payout amounts to approximately 75% of FY2024 net profit, a strong indicator of confidence in the Company’s financial health. While the Company does not adhere to a formal dividend policy, management has made it clear that future payouts will be balanced against reinvestment needs, with decisions based on cash flow, retained earnings, capital expenditure plans, and profitability.

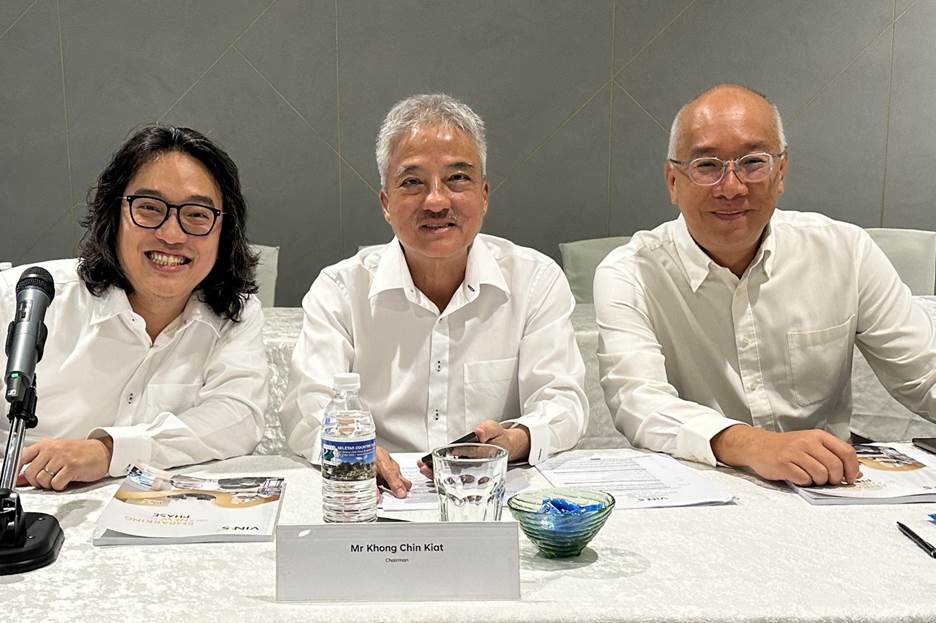

[L-R] Mr Galvin Khong, CEO of Vin’s Holdings Ltd, Mr Vincent Khong, Chairman of Vin’s Holdings Ltd, and Mr Loke Wai Ming, Deputy CEO of Vin’s Holdings Ltd

The Group recorded a 16.7% increase in gross profit, rising from S$12.0 million in FY2023 to S$14.0 million in FY2024, as cost of sales remained relatively flat. This led to an improvement in gross profit margin from 11.3% to 12.9%, largely driven by stronger performance in the higher gross margin Automobile After-Sales Services segment. Excluding one-off IPO-related expenses of S$919,000, profit before tax for FY2024 would have been S$3.6 million, comparable to FY2023.

Following Vin’s recent successful IPO on 15 April 2025, the Company is executing a growth strategy underpinned by four key pillars:

Vin’s reiterated their plans from the IPO, focusing on these strategic pillars to drive long-term growth. This integrated approach reflects a balanced approach, both digital and physical investments, aimed at supporting long-term growth in core automotive segments while exploring opportunities in adjacent markets.

Vin’s Midview City Showroom

Vin’s could benefit from the expected increase in Certificates of Entitlement (COE) supply starting in 2025, which may help ease car prices and support broader vehicle ownership. The Company’s sourcing from Japan and Europe helps limit risk amid global trade tensions. Domestically, the automotive market remains active, with new car registrations up 43.2% in 2024.

Although demand appears stable, ongoing changes in consumer preferences and greater interest in electric vehicles may impact future demand. Vin’s plans to enhance its after-sales services by expanding physical locations and upgrading technology, funded by IPO proceeds. The company is also increasing its focus on trading pre-owned electric vehicles and exploring potential partnerships with Chinese EV manufacturers.

Looking ahead, Vin’s is focused on building operational scale and unlocking new revenue streams through a mix of organic expansion and strategic partnerships. Management remains committed to driving margin improvements and enhancing service quality through technology investments, while exploring inorganic growth in complementary markets.

With decades of experience and a forward-thinking strategy, Vin’s is taking steps to adapt to an evolving automotive market while continuing to build on its post-listing momentum.

Explore Growth Opportunities at REITs Symposium 2025!

Discover more exciting small and mid-cap stocks within the REIT sector that could be the next big movers. Hear directly from CEOs, analysts, and industry experts as they dive into market trends, strategies, and hidden gems in the REIT and equities space.

Seats are limited, so register for yours today! www.Reitsymposium.com