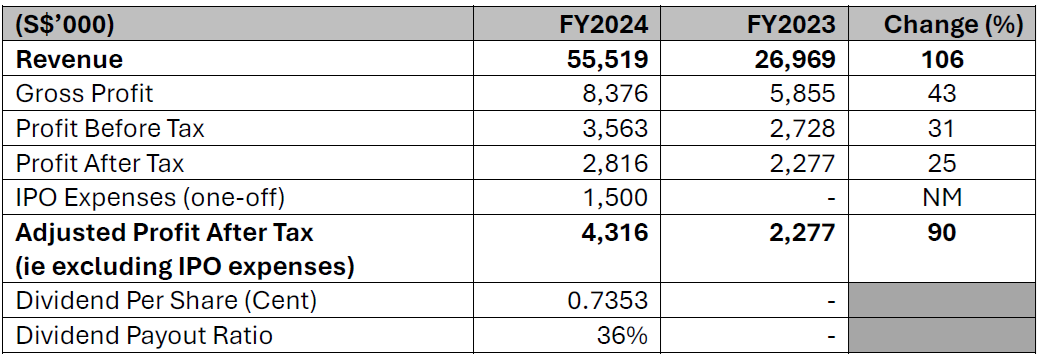

Attika Group Ltd. (“Attika”), the SGX-listed commercial interior decoration specialist, has reported it’s maiden set of financial results for the financial year ended 31 December 2024 (“FY2024”), with revenue more than doubling to S$55.5 million while its share price has appreciated 55% to 34 cents (as at 26 February 2025) since listing in November 2024.

Attika’s board of directors recommended a final tax-exempt dividend of 0.7353 cent per ordinary share amounting to S$1.0 million for FY2024 with an implied dividend payout ratio of 36% or dividend payout ratio of 36%.

Commenting on the stellar results, Mr Steven Tan, Executive Chairman and Managing Director said, “We are encouraged by our performance in FY2024, which reflects our team’s dedication, the trust our clients place in us, and our commitment to shareholders. In recognition of shareholders’ continued support, we have recommended a final dividend of S$1.0 million for FY2024, representing a 36% payout ratio.”

The successful completion of our major corporate office project demonstrates our capability to execute complex, large-scale interior decoration works to the highest standards. With our strengthened financial position post-listing and the positive industry outlook projected by BCA, we are confident in our ability to secure new contracts and deliver sustainable growth for shareholders,” he added.

Photo Credit: Attika. Mr Steven Tan (Left) Attika’s Executive Chairman and Managing Director

Attika's impressive revenue surge was primarily attributed to a significant corporate office project secured in Q4 FY2023 and completed in FY2024. This major project demonstrated the company's capability to handle large-scale corporate interior decoration works effectively.

Despite the significant increase in revenue, the company's gross profit increased at a relatively moderate rate by S$2.5 million or 43.1% from S$5.9 million in FY2023 to S$8.4 million in FY2024. This was primarily due to substantial increases in subcontracting costs required to meet project timelines, resulting in a gross profit margin decrease from 22% in FY2023 to 15% in FY2024.

Beyond the topline figures, the company’s financial strength is evident in its operating cash flow, which nearly doubled to S$10.9 million (FY2023: S$5.7 million). Attika’s profit after tax increased by 24% to S$2.8 million, with earnings per share rising to 2.07 cents (FY2023: 1.98 cents). When excluding the S$1.5 million in one-off listing expenses incurred in FY2024, adjusted profit after tax grew by an impressive 90%.

Since its listing on 8 November 2024, the Group has secured several new contracts, demonstrating continued business momentum post-IPO while its share price has risen 55% as at 26 February 2025. The company continues to proactively tender for additional projects as it strengthens its orderbook for long-term sustainable growth.

Photo Credit: Attika. Listing Day ceremony on 8 November 2024 at SGX Center

Attika’s strong operating cash flow signals health business operations and effective working capital management. The company’s cash and cash equivalents have tripled to S$9.0 million post-listing (31 Dec 2023: S$2.9 million), providing substantial financial flexibility to fund future growth initiatives.

Market opportunities remain robust, with the Building and Construction Authority (“BCA”) estimating demand to reach between S$39 billion and S$46 billion per year between 2026 and 2029, with the public sector leading this demand.

For investors keeping an eye on the performance of Singapore IPOs, Attika represents a compelling growth story. The 55% share price appreciation since IPO reflects market confidence in Attika’s business and growth prospects.

While the company experienced a reduction in gross profit margin due to higher subcontracting costs for its major project, the nearly doubled operating cashflow and tripled cash reserves demonstrate that Attika is managing its growth in a financially prudent manner. The significant increase in adjusted profit before tax (excluding listing expenses) further highlights the underlying strength of the business.

With its robust financial position, ongoing orderbook replenishment, and favourable industry projections, Attika is strategically positioned within Singapore’s expanding commercial interior decoration sector.

Reference: SGXNET:

This article is for information purposes only and does not constitute an offer, solicitation or recommendation to buy or sell securities. The information contained herein is not intended to provide investment, tax, legal or financial advice. Past performance is not necessarily indicative of future performance.

To keep these insights at your fingertips, subscribe and share our update.