Market Open on 8 November 2024 at 9am

In a city where property prices consistently make headlines and homeowners invest small fortunes in renovations, where do Singapore’s business owners go to transform commercial spaces? For the past decade, Attika Group Ltd. (“Attika”), has been the answer, boasting a track record of award-winning interior decoration projects across Singapore’s private and public sectors – from public libraries to hotels and offices.

Attika wrapped up its first day of trading on the Catalist board of the Singapore Exchange at 23.5 cents on 8 November 2024, 1.5 cents or 6.8% above its initial public offering (IPO) price of 22 cents per share. Just weeks after its IPO, Attika’s share price closed at 26.5 cents on 29 November 2024, 4.5 cents or 20% above its debut price, claiming the top spot as 2024’s best performing Catalist IPO to date.

Mr. Steven Tan, Managing Director and Executive Chairman, Attika Group Ltd, said, “This listing marks a new chapter in our journey to reach new heights within the interior fit-out industry. As we forge ahead, we remain focused on our mission of transforming interiors into vibrant and sustainable spaces for living, working and leisure – driven by skilled professionals and an unwavering commitment to quality.”

Managing Director and Executive Chairman Mr. Steven Tan

RHB Bank Berhad is the Full Sponsor, Issue Manager and the Placement Agent, together with KGI Securities (Singapore) Pte. Ltd as sub-placement agent.

Mr Alvin Soh, Head, Corporate Finance, RHB Bank Berhad, Singapore Branch, said,

“We are pleased to have partnered Attika to assist them on their successful listing on the SGX’s Catalist board. With our long-standing presence in Singapore, we remain committed to supporting local enterprises in their IPO journeys, while contributing to a vibrant capital market ecosystem.”

RHB Singapore’s Country Head, Danny Quah congratulating Attika’s Steven Tan

Investors can now participate in the world of high-end interior fit-out works, an industry expected to reach between S$4.8 billion to S$7.4 billion by 2027 amidst growing demand in Singapore. Attika’s operations are on a scale far beyond typical residential renovations. While the average renovation cost of a resale HDB is around S$67,000, Attika’s single largest project to date had a contract value exceeding S$40 million. The Company stands out among the select few industry players which hold the highest grading of L6 for interior decoration and finishing works from the Building and Construction Authority (“BCA”). This allows Attika to participate in tendering for and executing interior decoration projects in the public sector with no tendering limits and project value limits, opening doors to significantly larger and more lucrative opportunities.

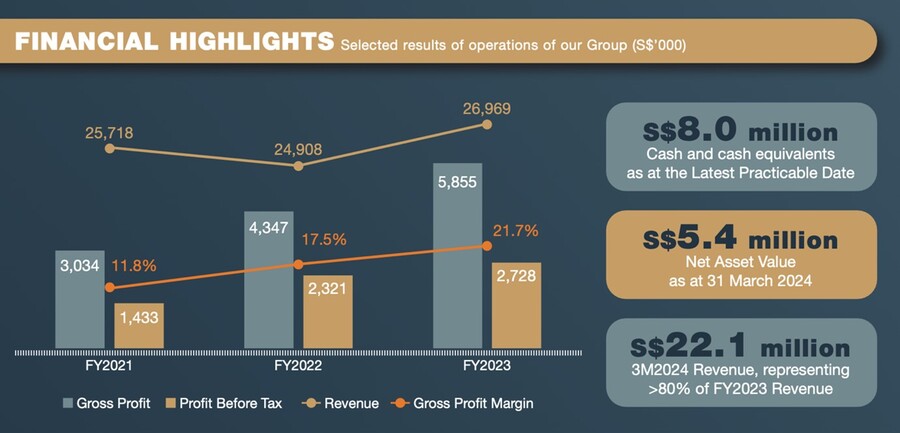

Attika’s success is driven by its experienced and dedicated management team, who have established the Company as a one-stop service provider with a strong and proven track record. Despite the challenges posed by the Covid-19 pandemic, Attika successfully navigated the post-Covid recovery, completing more than 40 projects during the three-year period between 2021-2023. This performance demonstrates Attika’s ability to capitalise on the return of construction demand, resulting in commendable growth in gross profit between 2021-2023.

Source: Offer Document

While Attika has shown impressive performance, the commercial interior decoration industry, much like the broader construction sector, is not without risks. Cost overruns and delays are not uncommon challenges. However, Attika has developed robust strategies to mitigate these issues. The Company leverages its established network of business relationships with other industry players to facilitate timely execution and achieve cost-savings through collaboration and mutual understanding of its operations and processes.

Moreover, to maintain greater control over quality and costs, Attika has invested in developing its own in-house production capabilities. The Company operates a fully equipped workshop staffed by 58 full-time carpenters, metal workers, and mechanical and engineering tradesmen. This vertical integration allows Attika to reduce reliance on external suppliers, ensure consistent quality and better manage project timelines and budgets.

While Attika has developed robust strategies to manage industry risks, the Company is also well-positioned to capitalise on favourable market conditions. Strong government support in Singapore’s construction sector, coupled with a robust pipeline of projects, is expected to result in continued growth in the interior fit-out works industry.

The BCA projects annual overall construction demand to reach between S$31 billion to S$38 billion between 2025 and 2028. The sustained construction demand is likely to create significant opportunities in the interior fit-out sector. Moreover, as Singapore’s tourism industry rebounds and more companies establish their regional offices in the city-state, demand from tourism-related properties and commercial office fit-out works will further fuel growth in the industry.

To take advantage of these positive market trends, Attika has developed a strategic plan for future growth. This includes diversifying into the residential and hospitality sectors, acquiring new equipment and machinery to enhance efficiency, and embarking on new markets in neighbouring countries such as Malaysia.

Central Public Library

Furthermore, Attika plans to expand through strategic investments and acquisitions. These will focus on businesses that are ancillary, complementary, or strategic to its existing core business. Specifically, the Company is targeting:

This multi-faceted approach demonstrates Attika’s commitment to holistic growth, addressing market expansion, operational efficiency, and workforce management simultaneously.

As Attika makes its mark on the Singapore Exchange, discerning investors might want to take note. But as with any investment, don’t forget to measure twice before you decide to renovate your portfolio.

Team AlphaInvest Holdings including ShareInvestor and Waterbrooks together with other professionals were part of Attika’s successful IPO journey

*Note: This article does not constitute financial product advice. You should consider obtaining independent and professional advice before making any financial decision.