From bustling sushi bars to packed anime conventions, Japanese culture has firmly embedded itself in Singapore and Malaysia. This cultural phenomenon isn’t just changing tastes – it’s creating lucrative business opportunities. Enter Food Innovators Holdings Limited (“FIH”), whose upcoming IPO on SGX Catalist offers investors a chance to tap into this burgeoning market at its source.

Founded in 2011, FIH is a one-stop solution provider for quality traditional Japanese and Japanese-inspired European cuisine restaurants.

In Singapore, some of the brands under its portfolio include sushi bar Kadohachi, grilled-meat restaurant Niku Katsumata, and Tendon Kohaku, which serves rice bowls.

Image: credits to Niku Katsumata website

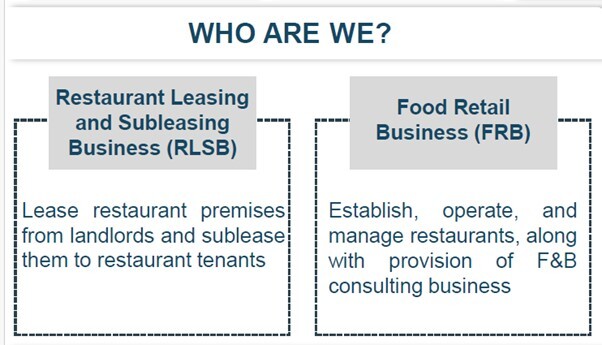

More than just a restaurant operator, the Group reaps synergistic benefits by operating two complementary businesses. This dual growth engine approach allows FIH to provide a one-stop solution for its customers’ restaurant management needs while introducing innovative brand concepts.

Leveraging its years of experience in the F&B industry, the Group operates a Restaurant Leasing and Subleasing Business (“RLSB”) in the Tokyo Metropolitan area of Japan.

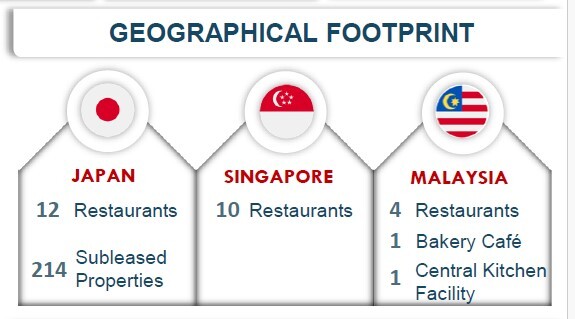

This segment matches properties with restaurant tenants, generating a stable recurring rental spread from 214 subleased properties with an impressive 99.2% occupancy rate.

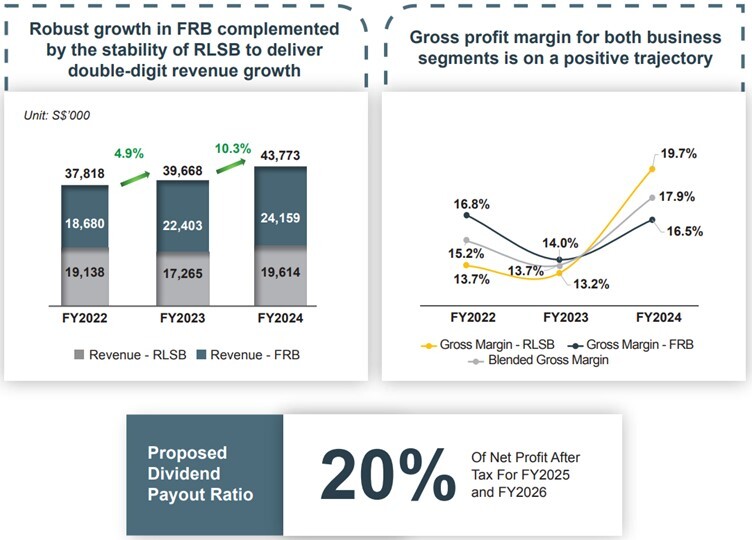

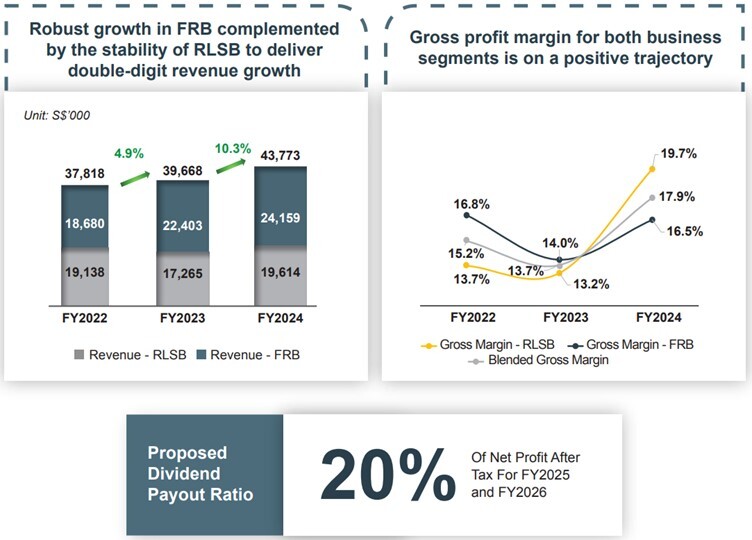

In FY2024, the RLSB segment contributed S$19.6 million, accounting for 43.9% of the Group’s total revenue.

As a restaurant operator, FIH establishes, operates and manages 26 restaurants across Japan, Singapore and Malaysia. Capitalising on the know-how gained in the RLSB, these restaurants specialise in various types of quality traditional Japanese and Japanese-inspired European cuisines, forming the Group’s Food Retail Business (“FRB”).

In FY2024, the FRB contributed S$24.2 million, accounting for 56.1% of the Group’s total revenue.

Financial Highlights. Source FIH

Geographical Footprint. Source FIH

Additionally, the Group provides kitchen equipment leasing services and F&B Consulting and Operations Management Services, which complement both its RLSB and FRB. These two complementary businesses collaboratively drive sustainably synergistic growth. This is reflected in the robust growth in FRB complemented by the stability of RLSB, delivering double-digit revenue growth and gross profit margins on a positive trajectory.

With Japanese restaurants just a stone’s throw away in any direction, how do F&B operators stay fresh in a competitive industry? FIH rises to this challenge through continuous innovation, including fresh dining experiences and interesting food concepts to meet evolving preferences. This strategy is driven by an experienced and dedicated management team, including a celebrity chef, with an established track record in the industry.

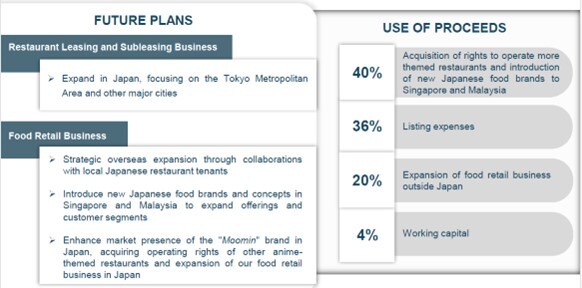

The F&B industry in Japan anticipates positive long-term growth, driven by favourable macroeconomic factors. The foreign tourism boom post Covid-19 has led to a sharp increase in F&B spending and accelerated restaurant sales. Capitalising on these favourable tailwinds, FIH plans to expand its RLSB in the Tokyo Metropolitan Area and other major cities in Japan, positioning itself to benefit from the growing demand for restaurant spaces.

In addition, the Group also plans to enhance the market presence of the “Moomin” brand in Japan. The Group currently holds the Moomin character brand licence and operates a café with that theme in Karuizawa, Japan. Building on this experience, FIH aims to acquire operating rights of popular anime-themed restaurants and further expand its FRB in Japan.

Meanwhile, across Malaysia and Singapore, the tourism recovery and rising affluence are set to boost the F&B sector. Building on its success in Japan, FIH plans to introduce new Japanese good brands and innovative dining concepts in these markets, aiming to enhance its offerings and capture a wider range of customer segments. The Group will collaborate with local Japanese restaurant operators for strategic overseas expansion.

FIH is offering 14 million shares at S$0.22 apiece, raising S$3.1 million in gross proceeds. Applications for FIH’s shares close at noon on 14 October 2024. The shares are expected to commence trading on a ready basis at 9am on Wednesday 16 October 2024, marking a new chapter in FIH’s growth story.

FIH has a proposed dividend payout ratio of 20% for FY2025 and FY2026 Net Profit after tax.

PrimePartners Corporate Finance Pte. Ltd. (“PPCF”) is the Issue Manager, Placement agent and the Continuing Sponsor for FIH.

Future Plans and Use of Proceeds. Source FIH

As the company prepares to go public, a question lingers: Will investors queue up for FIH shares with the same enthusiasm that diners line up outside the Group’s popular restaurants?

Brands by Geographical Locations. Source FIH

*Note: This article does not constitute financial product advice. You should consider obtaining independent and professional advice before making any financial decision.